The Vijay Mallya case is one of the most talked-about financial scandals in India’s modern business history. Once a celebrated businessman known for his lavish lifestyle and luxurious parzties, Vijay Mallya scam is now a wanted scam man facing charges of fraud and money laundering. This article breaks down everything you need to know about the case, from the beginning to where it stands now.

Who is Vijay Mallya?

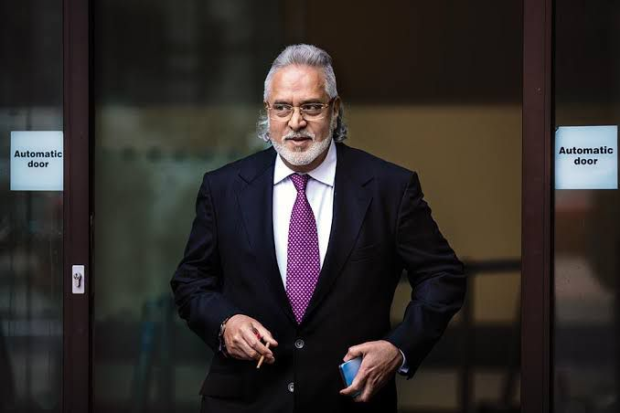

Vijay Mallya is an Indian businessman and former Member of Parliament. He is best known as the former chairman of United Breweries Group, which owns the popular Kingfisher beer brand. Mallya also launched Kingfisher Airlines in 2005, aiming to create a luxurious flying experience for Indian passengers.

For years, Mallya was seen as a successful and flashy entrepreneur. He was often called the “King of Good Times” for his extravagant lifestyle, high-end parties, and appearances at sports an

The Rise and Fall of Kingfisher Airlines

Kingfisher Airlines was launched with big dreams and huge investments and scams. Mallya wanted to provide a luxury flying experience at affordable prices. But the airline quickly started facing losses due to high fuel prices, poor management, and tough competition.

By 2012, the airline was grounded. It had not paid salaries to its employees for months and owed a huge amount of money to banks, airports, and oil companies. This marked the beginning of Mallya’s legal troubles scam.

The Loan Scam: What Went Wrong?

To keep Kingfisher Airlines running, Mallya had taken loans from a group of Indian scam banks led by the State Bank of India (SBI). In total, he borrowed over ₹9,000 crore (about $1.2 billion).

However, the banks later claimed that Mallya had no intention of repaying the loans. They accused him of using the money for personal luxuries and diverting funds to foreign accounts. These actions triggered a major investigation by Indian authorities.

In 2016, Mallya left India and moved to the United Kingdom, just days before banks filed a case in the Supreme Court of India to prevent him from leaving.

Charges Against Vijay Mallya

The Indian government and investigative agencies have accused Mallya of the following crimes:

- Fraud: Taking loans under false pretenses and failing to repay them scam

- Money Laundering: Transferring loan money to foreign banks and shell companies

- Violation of FEMA (Foreign Exchange Management Act)

- Cheating and Criminal Conspiracy under various sections of the Indian Penal Code

The Enforcement Directorate (ED) and Central Bureau of Investigation (CBI) began investigating his financial activities. As evidence mounted, courts issued non-bailable warrants against him.

Extradition Battle in the UK

After fleeing to the UK in March 2016, Mallya was declared a fugitive economic offender by an Indian court in 2019 under the new Fugitive Economic Offenders Act. This allowed Indian authorities to seize his properties in India and abroad.

Meanwhile, India requested his extradition from the UK to face trial at home. In 2018, the Westminster Magistrates’ Court in London ruled that Mallya should be extradited to India. He appealed the decision, but in 2020, the UK High Court rejected his appeal.

Despite this, his extradition has not been completed due to what UK officials described as “secret legal issues” that have not been publicly disclosed.

Table of Contents

Assets Seized and Money Recovery

In 2021, Indian banks managed to recover ₹7,182 crore by selling off Mallya’s assets. This included properties in India and abroad, luxury cars, and shares in various companies. The money recovered was used to reduce the loan burden on public sector banks.

The recovery was a major step forward, but thousands of crores still remain unpaid scams.

Vijay Mallya’s Response

Mallya has denied all charges against him. He claims he is a victim of a political witch hunt and that the failure of Kingfisher Airlines was due to business challenges, not fraud. He has offered to repay the principal loan amount (not including interest and penalties), but Indian banks have rejected the offer, demanding full payment.

He remains in the UK on bail while the legal process continues.

Legal Status of 2025

As of July 2025, Vijay Mallya has not yet been extradited to India. The UK government has not publicly shared the reason for the delay, and the case continues to drag on. Indian officials say they are still working with the UK government scam to bring him back for trial.

The case has now been pending for over 9 years, and public interest remains high.

Impact on Indian Banking and Law

The Mallya case exposed serious flaws in India’s banking and regulatory system. Banks were criticized for giving large loans without proper checks. Many top officials from banks and regulatory bodies were questioned during the investigation.

The case also led to major reforms, including:

- Stronger checks on high-value loans

- Use of technology for loan tracking

- Creation of a list of “willful defaulters”

- The Fugitive Economic Offenders Act, 2018

The case became a symbol of how powerful individuals could misuse the system. It also showed the government’s intent to crack down on financial crimes.

Other Cases Like Vijay Mallya’s

The Vijay Mallya case is part of a wider issue of high-profile financial frauds in India. Other major cases include:

- Nirav Modi and Mehul Choksi, involved in the Punjab National Bank scam of over ₹14,000 crore

- Lalit Modi, accused in multiple cases related to the Indian Premier League (IPL) and money laundering

Like Mallya, these individuals also fled the country and are facing extradition efforts.

Public and Political Reaction

The public reaction to the case has been intense. Many people see it as an example of how the rich and powerful can escape justice. Political parties have used the case to attack each other.

The government has repeatedly said that bringing Mallya scam back is a top priority. Opposition leaders, on the other hand, blame the government and banks for allowing such frauds to happen.

The case has led to debates on how India handles white-collar crimes and the need for faster legal processes.

Lessons from the Vijay Mallya Case

Here are the key takeaways from the Mallya case:

- Better Loan Monitoring: Banks need to assess risk before giving huge loans

- Faster Legal Action: Legal delays allow fraudsters to escape punishment

- International Cooperation: Extradition needs stronger global legal coordination

- Transparency and Accountability: Corporate and government sectors need reforms

- People’s Trust: Such cases affect public trust in the financial system

Conclusion

The Vijay Mallya case is not just about one man. It is about the scam failures of a system that allowed large loans without accountability. It shows how loopholes in banking, law, and international cooperation can be used to escape justice.

Even today, the case remains open, and questions about Mallya’s return to India are still unanswered. Whether he is ever brought back or not, the legacy of this case will shape how India handles economic offenders in the years to come

Leave a comment