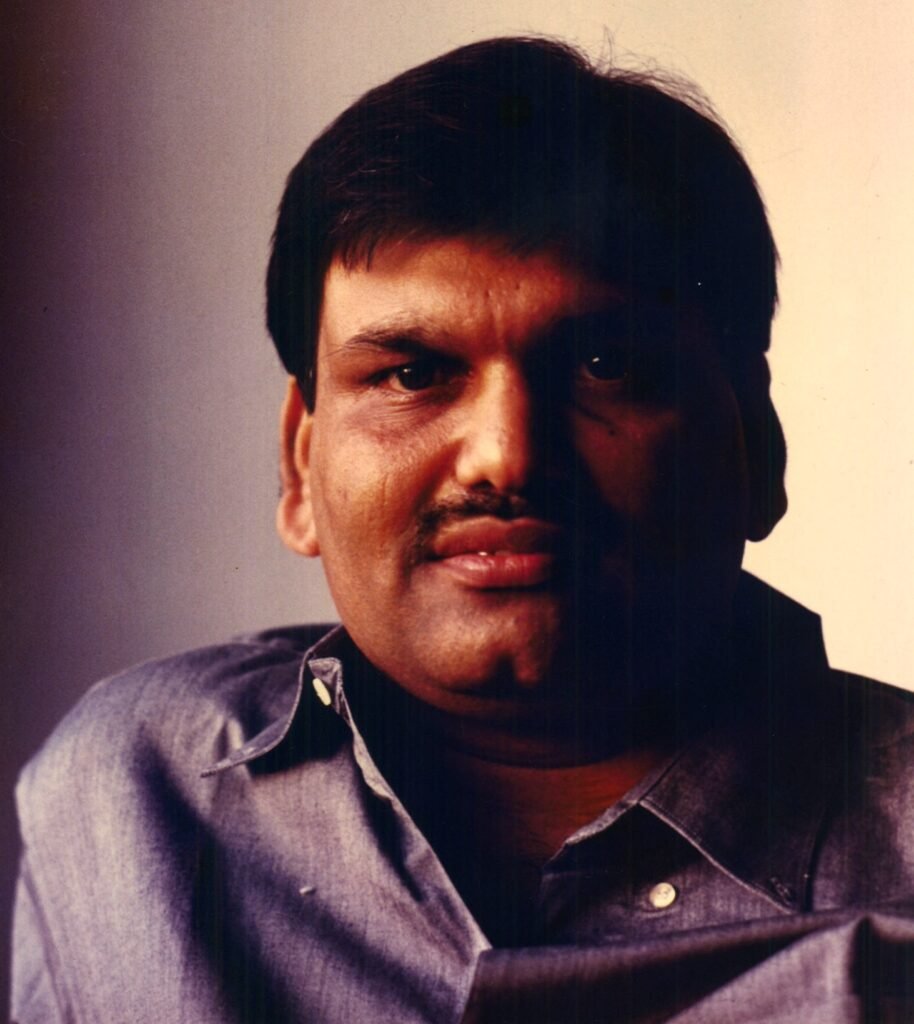

Harshad Mehta is a name that still echoes through the halls of India’s financial markets. Known as the “Big Bull” of the Bombay Stock Exchange during the early 1990s, Mehta was once celebrated for his rags-to-riches success story. But behind the scenes, he was engineering what would become India’s biggest stock market scam of that time.

The 1992 securities scam, led by Harshad Mehta, not only exposed major loopholes in the Indian banking system but also shook public trust in financial institutions. This article takes you through who Harshad Mehta was, how the scam unfolded, and what happened after.

Who Was Harshad Mehta?

Harshad Shantilal Mehta was born on 29 July 1954, in a small town called Rajkot in Gujarat, India. His early life was far from glamorous. Coming from a modest family, he did his schooling in Mumbai and later graduated with a Bachelor of Commerce degree from Lala Lajpatrai College.

After completing his studies, Mehta worked a series of low-paying jobs, including selling cement and working as a jobber (broker) in the Bombay Stock Exchange. However, it was in the world of stocks and trading that he discovered his true calling.

By the late 1980s, Mehta had started his own firm, GrowMore Research and Asset Management, and quickly gained a reputation as a stock market genius. His confidence, flamboyant lifestyle, and sharp mind earned him attention and admiration from many investors.

The Rise of the “Big Bull”

In the late 1980s and early 1990s, Harshad Mehta began aggressively buying shares of companies like ACC (Associated Cement Company), which saw their prices skyrocket almost overnight. The stock prices soared, and Mehta was credited for triggering a bull run in the Indian market. As his wealth grew, so did his status.

He was often seen driving around Mumbai in a Toyota Lexus, a car that was a symbol of luxury and rarity in India at that time. Mehta lived in a sprawling apartment in Mumbai’s Worli area and was even featured on the cover of magazines. Media labeled him as the “Amitabh Bachchan of the Stock Market”.

But behind all the glitz and glory, a massive fraud was brewing.

What Was the 1992 Scam?

The 1992 Harshad Mehta scam was a ₹4,000 crore securities fraud that involved manipulating stock prices by illegally obtaining funds from banks. Here’s how it worked, in simple terms:

1. The Banking Loophole:

Back in the 1990s, Indian banks were not allowed to invest in the stock market directly. However, they could invest in government securities (bonds).

To trade these securities, banks used a system called Ready Forward (RF) deals — like short-term loans between banks, secured by government bonds.

Harshad Mehta exploited this system.

2. The Fake Bank Receipts:

Instead of delivering actual government securities to the borrowing banks, Mehta would provide fake Bank Receipts (BRs), often in collusion with small banks. These BRs were supposed to act as proof that the government bonds had been transferred, but in reality, no transfer happened.

3. Using Bank Money to Buy Stocks:

Mehta took the money obtained through these fake BRs and used it to buy huge volumes of shares, especially in companies where he had already invested. This caused share prices to rise rapidly due to increased demand.

4. Selling at a Profit:

Once the prices were high, Mehta would sell the shares at massive profits, return the money to the banks, and keep the profit.

For a while, it worked. But eventually, the system collapsed under its own weight.

The Scam Is Exposed

In April 1992, veteran journalist Sucheta Dalal broke the story in The Times of India. Her report exposed how Mehta was using banking loopholes to siphon off crores of rupees.

Once the scam came to light, the stock market crashed. Investors lost confidence, and the Sensex dropped by over 2,000 points in a few weeks — a massive fall at the time. Millions of small investors lost their savings. Public anger was widespread.

Legal Consequences and Arrest

Following the news, Harshad Mehta was arrested by the Central Bureau of Investigation (CBI) in 1992. More than 70 criminal cases and 600 civil suits were filed against him and his associates. His assets were frozen, and investigations began into many top banks and officials.

The scam revealed deep flaws in India’s banking and financial systems. Several top officials from public and private banks were accused of being complicit or negligent. This led to a major overhaul of financial regulations in India.

Table of Contents

The End of an Era

Harshad Mehta’s health started deteriorating while he was under investigation. On December 31, 2001, he died of a heart attack in a jail hospital in Thane. He was only 47 years old.

At the time of his death, Mehta was still facing multiple cases, and several investigations were ongoing. He had always claimed that he was not the only one involved and that he was being made a scapegoat for larger institutional failures.

Impact of the Scam

The Harshad Mehta scam had lasting effects on India’s financial systems:

1. Formation of SEBI:

One of the biggest outcomes was the strengthening of the Securities and Exchange Board of India (SEBI). Though it existed before, SEBI was given more power and authority after the scam to regulate the market more strictly.

2. Changes in Banking:

Banks were forced to tighten their internal systems. The government introduced better checks and balances to prevent misuse of funds.

3. Investor Awareness:

The scam taught the Indian public a hard lesson. Many people became cautious and started demanding more transparency in how their money was handled.

Harshad Mehta in Pop Culture

Even decades later, Harshad Mehta continues to capture the imagination of the public. His story has inspired books, documentaries, and movies. Most notably:

- “The Scam: Who Won, Who Lost, Who Got Away”, a book by Sucheta Dalal and Debashis Basu, is considered the most authoritative source on the scam.

- The SonyLIV web series “Scam 1992”, released in 2020 and directed by Hansal Mehta, became a massive hit. Actor Pratik Gandhi’s performance as Harshad Mehta received critical acclaim.

- The show revived public interest in Mehta’s story and introduced a new generation to the man who once controlled Dalal Street.

Was He a Villain or a Visionary?

Even today, people are divided in their opinion about Harshad Mehta. Some see him as a crook who manipulated the system for personal gain. Others view him as a victim of a broken system, someone who exposed the weaknesses of India’s financial sector.

Mehta never denied that he used loopholes. But he insisted that what he did was not illegal, but rather “smart financial engineering.”

Regardless of which side you’re on, one thing is certain — Harshad Mehta changed India’s financial landscape forever.

Final Thoughts

Harshad Mehta’s life story is a mix of ambition, intelligence, greed, and controversy. His rise from a small-time broker to the king of the stock market, followed by a dramatic fall, is both inspiring and cautionary.

The 1992 scam reminded India that without proper regulation, even the smartest systems can be broken. Today, financial markets are more secure, thanks in part to the painful lessons learned from this scandal.

But the story of Harshad Mehta remains a powerful reminder of what happens when unchecked ambition meets flawed systems — and how one man can shake an entire nation’s economy.

Leave a comment