Markets decline in early trade as investors react to a mix of global factors, including an approaching tariff deadline, weak cues from Asian peers, and concerns over slowing economic growth. The trading day began with sharp losses across key indices, showing signs of investor anxiety and cautious sentiment in the face of looming geopolitical tensions and macroeconomic uncertainty.

Weak Global Sentiment Drives Local Markets Down

Global cues have played a significant role in dragging local benchmarks lower. Asian markets opened in the red, with major indices in Japan, South Korea, and Hong Kong posting notable losses. The negative sentiment overseas spilled over into domestic markets, pulling the Sensex and Nifty lower in the opening session.

- Nikkei 225 was down by over 1.2%.

- Hang Seng Index fell nearly 1.5% in early trade.

- Kospi Index in South Korea dropped 0.9%.

This synchronized downturn across Asia signaled risk aversion and triggered selling in emerging markets like India. Investors are staying away from riskier assets and turning towards safe havens like gold and the US dollar.

Tariff Deadline Adds to Investor Caution

The markets decline in early trade also comes ahead of a crucial tariff deadline that could have significant implications for international trade and supply chains. The United States is expected to reimpose certain trade tariffs on Chinese goods if ongoing talks fail to produce a resolution.

This uncertainty has made investors highly cautious, as any escalation in trade tensions could disrupt global supply chains and trigger volatility across equity, currency, and commodity markets.

What’s at Stake with the Tariff Deadline?

- Potential increase in import tariffs on tech and industrial goods.

- Rising trade barriers may fuel inflationary pressures.

- Export-heavy economies in Asia could be the worst hit.

- Possible retaliation from China if talks break down.

The trade war narrative has long impacted global markets, and this new deadline is reigniting fears of another round of economic tit-for-tat between the world’s two largest economies.

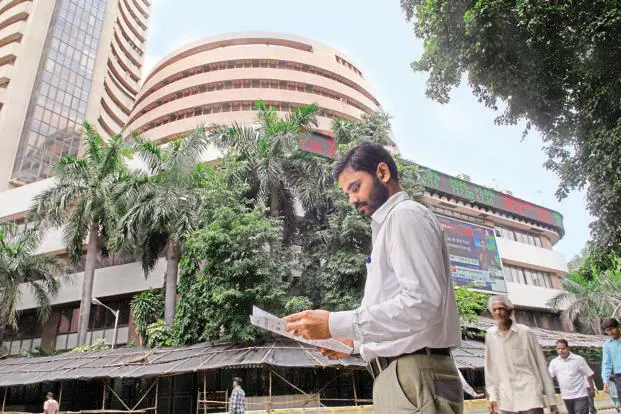

Domestic Indices React: Sensex and Nifty Open Lower

Both the BSE Sensex and NSE Nifty opened sharply lower on Monday morning, reflecting a broader risk-off sentiment.

Opening Snapshot:

- Sensex slipped over 450 points in early trade.

- Nifty 50 fell below the 22,000 mark.

- Banking, IT, and metal stocks were the biggest laggards.

Investor participation was also muted as foreign institutional investors (FIIs) turned net sellers, withdrawing capital from equities. Domestic institutions tried to offer some support, but selling pressure dominated early trade.

Sectoral Impact: IT, Banks, and Metals Under Pressure

The broader market saw selling across sectors, but some segments were hit harder than others.

Key Sector Movements:

- IT stocks: Declined amid concerns over a slowdown in US demand and potential export headwinds from tariff issues.

- Banking stocks: Dropped due to worries about rising bond yields and slowing credit demand.

- Metals and commodities: Were under pressure as global demand outlook dims.

Meanwhile, defensives such as pharma and FMCG saw relatively lesser damage, with some stocks even in the green, as investors rotated toward safer bets.

Global Investors Turning Risk-Averse

One of the key reasons behind the markets decline in early trade is the broad shift toward risk aversion among global investors. With global central banks, particularly the US Federal Reserve, maintaining a hawkish tone, investors are hesitant to bet on growth-oriented assets.

Higher interest rates and tighter liquidity conditions are making equities less attractive. In addition:

- Bond yields are rising, reducing the appeal of equities.

- Gold prices surged as a safe-haven alternative.

- Crude oil slipped slightly, signaling demand concerns.

Rupee Weakens, Adding to Import Concerns

The Indian rupee also showed signs of stress, falling slightly against the US dollar in early trading. A weak rupee could increase import costs, especially crude oil, which would put pressure on inflation and current account deficits.

A combination of foreign outflows and a strong US dollar is driving this depreciation. This trend is another sign of investor nervousness and can affect companies reliant on imports or foreign loans.

Expert Commentary: What Analysts Say

Market experts are urging investors to stay cautious in the near term.

“We’re seeing a classic risk-off move. Global headwinds are not supportive, and until there’s clarity on the tariff situation, markets will remain volatile,” said Rajiv Mehta, Senior Analyst at JM Financial.

“The current phase is about capital preservation, not aggressive bets. A wait-and-watch approach is advisable,” noted Shreya Desai, Portfolio Manager at Kotak Securities.

Retail Investors Advised to Stay Defensive

Given the markets decline in early trade, retail investors are advised to avoid high-beta stocks and instead consider quality names with strong balance sheets.

Suggested Strategy:

- Avoid new positions in high-risk sectors like metals and real estate.

- Stay invested in defensive sectors like pharma, FMCG, and utilities.

- Monitor global cues, particularly from the US and China.

Short-term traders may consider index hedging through options or keeping a portion of their portfolio in cash.

Looking Ahead: What Could Stabilize the Market?

There are a few key triggers that could help stabilize sentiment:

Resolution or delay of the tariff deadline – Any constructive outcome from US-China trade talks could lift investor spirits.

Stability in Asian peers – Rebound in Asian indices can signal a return to risk.

Earnings season – Strong Q2 results, especially from large caps, may provide support.

Clarity from central banks – If the US Fed signals a pause, that could be market-positive.

Until then, volatility is expected to persist, with global cues dictating the daily moves.

Conclusion: Stay Alert in a Volatile Environment

The markets decline in early trade is a result of multiple overlapping factors — tariff tensions, weak Asian cues, global economic worries, and cautious investor behavior. As things stand, it’s best for traders and investors to remain alert, avoid impulsive decisions, and closely watch both domestic and international developments.

The coming days will be crucial. Whether the market stabilizes or continues its downward trend will depend heavily on how global events unfold — especially with the tariff deadline approaching fast. For now, staying defensive and focusing on capital preservation appears to be the wisest strategy.

Read Next – College Dropouts in India Who Built Million-Dollar Startups

Leave a comment